The Wall Street Journal is an excellent resource for data mining, albeit not all reports are downloadable into excel (only the Historical Prices are). For this reason, we must copy and paste the income statement, balance sheet, and statement of cash flow separately into Excel in order to build an all-encompassing pro forma statement. However, in so doing, we build an automated process (macro) that takes the pasted data and arranges it in such a way that helps our efforts and is aesthetically sound.

What is a pro forma statement?

Pro Forma Financial Analysis

Pro Forma

- Latin term translating to “for the sake of form.”

Financial Analysis

- Income Statement

- Balance Sheet

- Statement of Cash Flows

As we discussed in our introduction, we can obtain the financials of any publicly traded company via:

- Yahoo Finance

- The Wall Street Journal

- The investor relations section of the corporation’s website

Piecing together a pro forma from the investor relations section of the company’s website can prove to be quite cumbersome.

- Some companies don’t have exportable excel files

- Makes the workload more tedious and time consuming

- It confuses certain line items that are available in other reliable sources

Income Statement

- A company’s performance measured by revenues and expenses

- In Economics:

Profit:

- In Finance/ Accounting:

Profit = Revenue – Cost

- Operating Income (or Loss) = Total Revenue – Total Operating Expenses

- EBIT = Earnings Before Interest and Taxes

- Net Income from Continuing Operations = Total Other Income (and/or Expenses) Net + EBIT – Income Tax Expense

Balance Sheet

- Assets = Liabilities + Shareholder’s Equity

Cash Flow Statement

- Cash from Operating Activities

- Cash from Investing Activities

- Cash from Financing Activities

- We are going to compute Free Cash Flow (FCF) and use the discounted cash flow model (DCF) to valuate a company.

- Before we compute the FCF, let’s remember that financing activities of the cash flow statement can be disregarded.

- FCF = Operating activities – Capital Expenditures (CAPEX)

Recording Our First Macro

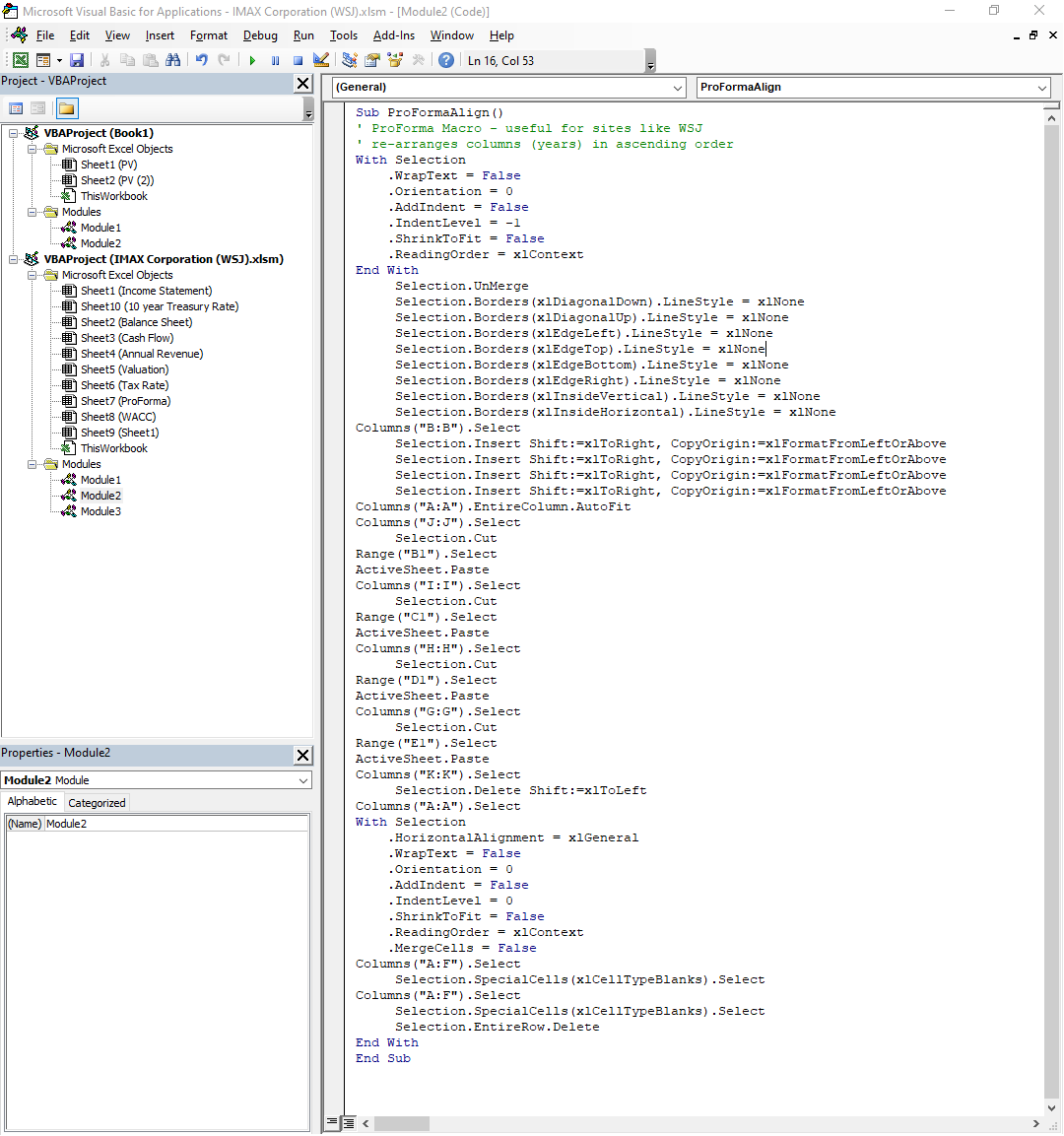

We will record a macro (automated process) that will create a script on the back end (in VBA).

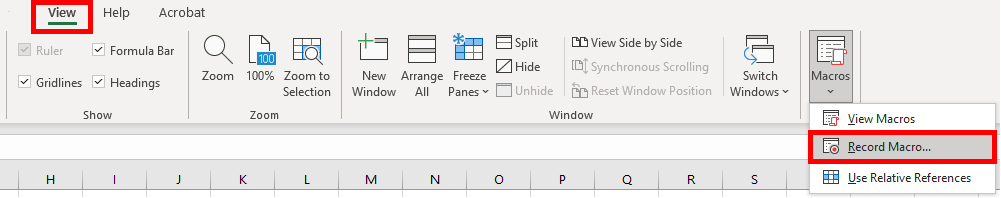

- In Excel, click on “View,” then “Macros,” and click on “Record Macro.”

Make sure that you have your steps mapped out such that you do not make any mistakes in the process (i.e., accidentally click or type somewhere that was not intended).

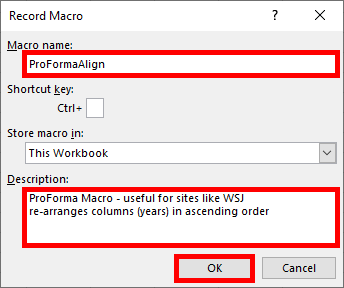

Ensure that you name your macro such that it DOES NOT contain any spaces.

Write-up an optional description.

Click “OK.”

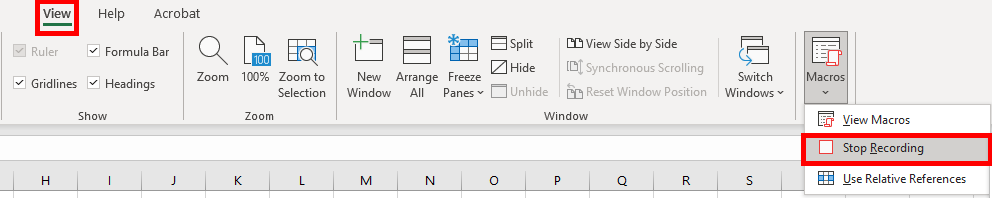

Once you are finished going through the process of recording a macro, go back to “View,” “Macros,” and ensure to click on “Stop Recording.”

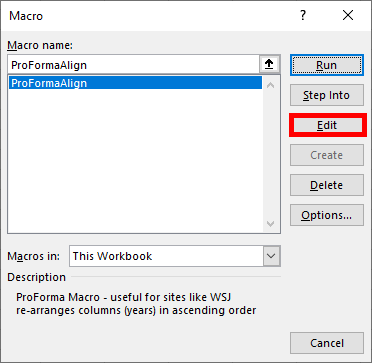

- To view the resulting script, go back to the process in the diagram above.

- The resulting dialog box pops up. Click “Edit.”

- Let’s name our macro: “WSJProForma.”

- Let’s add the following description:

“ProForma Macro – useful for sites like WSJ

re-arranges columns (years) in ascending order”

- Select all data in range: (column A – column K).

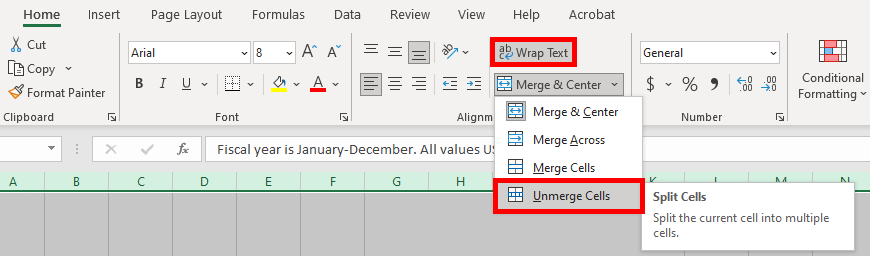

- Unselect “Wrap Text.”

- With the data still selected, click on “Unmerge Cells.”

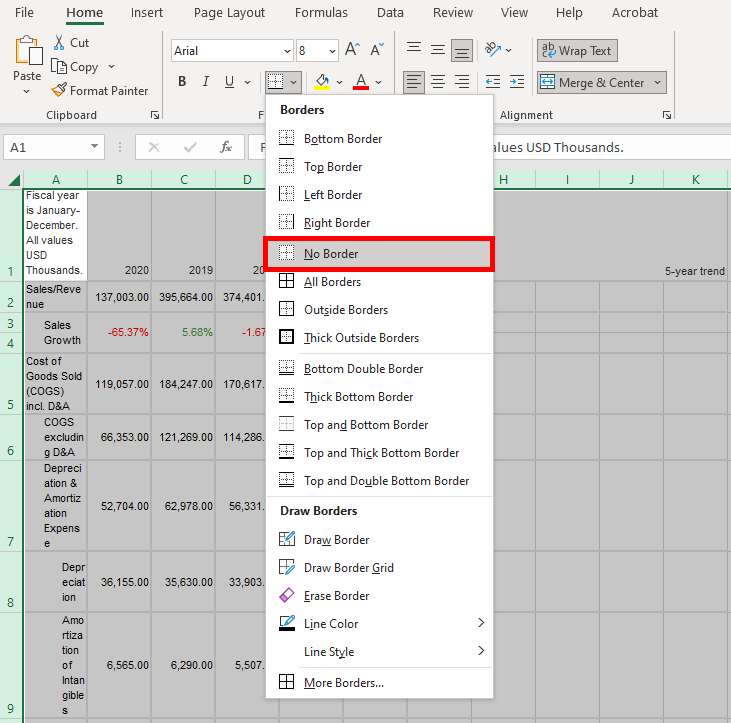

- Get rid of the border surrounding the data set (you want to ensure to remove all borders in columns A-K ).

- Insert a blank column in front of column B (where the header is marked as 2020).

- Repeat step 7 (above) 4 times until 4 blank columns are created in front of 2020. You can do this by pressing down ctrl + y on your keyboard 3 more times as a shortcut. The reason for creating 4 more columns to the front of 2020 is so that we can proceed to rearrange the years in chronological order.

- Highlight column J (where the header is marked as year 2016), copy the data, and paste the data into column A. Do the same for columns I – F , until all the dates are rearranged in chronological order.

- If there is any data in column K: such as “5 year-trend, etc.,” ensure to delete it. You can do this by deleting column K in its entirety. Data in column K is what was left over from the copying and pasting of original data.

- Go back to column A , highlight it, and align it to the left.

- This concludes the steps for this macro. Ensure to go back to the View tab on top of the Excel menu, go to “Macros,” and click on “Stop Recording.”

This takes us to the VBA Editor. On the back end, a screenshot of the script for the macro is shown below:

Wall Street Journal Pro Forma Macro (Script)

Sub ProFormaAlign()

' ProForma Macro - useful for sites like WSJ

' re-arranges columns (years) in ascending order

With Selection

.WrapText = False

.Orientation = 0

.AddIndent = False

.IndentLevel = -1

.ShrinkToFit = False

.ReadingOrder = xlContext

End With

Selection.UnMerge

Selection.Borders(xlDiagonalDown).LineStyle = xlNone

Selection.Borders(xlDiagonalUp).LineStyle = xlNone

Selection.Borders(xlEdgeLeft).LineStyle = xlNone

Selection.Borders(xlEdgeTop).LineStyle = xlNone

Selection.Borders(xlEdgeBottom).LineStyle = xlNone

Selection.Borders(xlEdgeRight).LineStyle = xlNone

Selection.Borders(xlInsideVertical).LineStyle = xlNone

Selection.Borders(xlInsideHorizontal).LineStyle = xlNone

Columns("B:B").Select

Selection.Insert Shift:=xlToRight, CopyOrigin:=xlFormatFromLeftOrAbove

Selection.Insert Shift:=xlToRight, CopyOrigin:=xlFormatFromLeftOrAbove

Selection.Insert Shift:=xlToRight, CopyOrigin:=xlFormatFromLeftOrAbove

Selection.Insert Shift:=xlToRight, CopyOrigin:=xlFormatFromLeftOrAbove

Columns("A:A").EntireColumn.AutoFit

Columns("J:J").Select

Selection.Cut

Range("B1").Select

ActiveSheet.Paste

Columns("I:I").Select

Selection.Cut

Range("C1").Select

ActiveSheet.Paste

Columns("H:H").Select

Selection.Cut

Range("D1").Select

ActiveSheet.Paste

Columns("G:G").Select

Selection.Cut

Range("E1").Select

ActiveSheet.Paste

Columns("K:K").Select

Selection.Delete Shift:=xlToLeft

Columns("A:A").Select

With Selection

.HorizontalAlignment = xlGeneral

.WrapText = False

.Orientation = 0

.AddIndent = False

.IndentLevel = 0

.ShrinkToFit = False

.ReadingOrder = xlContext

.MergeCells = False

Columns("A:F").Select

Selection.SpecialCells(xlCellTypeBlanks).Select

Columns("A:F").Select

Selection.SpecialCells(xlCellTypeBlanks).Select

Selection.EntireRow.Delete

End With

End Sub

Let’s save the file as a macro enabled workbook and copy and paste the remaining pro forma statements into our excel file into separate sheets. So, in effect, we will have 3 sheets:

- Income Statement

- Balance Sheet

- Cash Flow

Below is the pro forma for IMAX Corporation from 2013 - 2020.

IMAX Corporation Pro Forma from Wall Street Journal (2013-2020)

| A | B | C | D | E | F | G | H | I | J | |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Fiscal year is January-December. All values USD Thousands. | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | Formula |

| 2 | Income Statement | |||||||||

| 3 | Sales/Revenue | 287,937.00 | 290,541.00 | 373,805.00 | 377,334.00 | 380,767.00 | 374,401.00 | 395,664.00 | 137,003.00 | |

| 4 | Sales Growth | - | 0.90% | 28.66% | 0.94% | 0.91% | -1.67% | 5.68% | -65.37% | |

| 5 | Cost of Goods Sold (COGS) incl. D&A | 124,952.00 | 118,577.00 | 156,377.00 | 176,735.00 | 198,540.00 | 170,617.00 | 184,247.00 | 119,057.00 | |

| 6 | COGS excluding D&A | 88,267.00 | 85,647.00 | 114,590.00 | 130,782.00 | 132,295.00 | 114,286.00 | 121,269.00 | 66,353.00 | |

| 7 | Depreciation & Amortization Expense | 36,685.00 | 32,930.00 | 41,787.00 | 45,953.00 | 66,245.00 | 56,331.00 | 62,978.00 | 52,704.00 | |

| 8 | Depreciation | 16,239.00 | 17,764.00 | 21,361.00 | 25,532.00 | 29,915.00 | 33,903.00 | 35,630.00 | 36,155.00 | |

| 9 | Amortization of Intangibles | 2,854.00 | 2,988.00 | 3,285.00 | 3,235.00 | 4,319.00 | 5,507.00 | 6,290.00 | 6,565.00 | |

| 10 | Amortization of Deferred Charges | 17,592.00 | 12,178.00 | 17,141.00 | 17,186.00 | 32,011.00 | 16,921.00 | 21,058.00 | 9,984.00 | |

| 11 | COGS Growth | - | -5.10% | 31.88% | 13.02% | 12.34% | -14.06% | 7.99% | -35.38% | <– =(F5-E5)/E5 |

| 12 | Gross Income | 162,985.00 | 171,964.00 | 217,428.00 | 200,599.00 | 182,227.00 | 203,784.00 | 211,417.00 | 17,946.00 | |

| 13 | Gross Income Growth | - | 5.51% | 26.44% | -7.74% | -9.16% | 11.83% | 3.75% | -91.51% | |

| 14 | Gross Profit Margin | - | - | - | - | 47.86% | - | - | 13.10% | |

| 15 | SG&A Expense | 98,131.00 | 106,898.00 | 121,564.00 | 134,342.00 | 135,656.00 | 133,038.00 | 129,034.00 | 132,933.00 | |

| 16 | Research & Development | 14,771.00 | 16,096.00 | 12,730.00 | 16,315.00 | 20,855.00 | 13,728.00 | 5,203.00 | 5,618.00 | |

| 17 | Other SG&A | 83,360.00 | 90,802.00 | 108,834.00 | 118,027.00 | 114,801.00 | 119,310.00 | 123,831.00 | 127,315.00 | |

| 18 | SGA Growth | - | 8.93% | 13.72% | 10.51% | 0.98% | -1.93% | -3.01% | 3.02% | |

| 19 | EBIT | 64,854.00 | 65,066.00 | 95,864.00 | 66,257.00 | 46,571.00 | 70,746.00 | 82,383.00 | -114,987.00 | |

| 20 | Unusual Expense | -1,258.00 | 4,510.00 | 2,476.00 | 4,111.00 | 17,399.00 | 24,273.00 | 3,567.00 | 9,137.00 | |

| 21 | Non Operating Income/Expense | -1,012.00 | -2,486.00 | -5,517.00 | -3,978.00 | 1,754.00 | -1,796.00 | -2,792.00 | -378.00 | |

| 22 | Non-Operating Interest Income | 55 | 405 | 968 | 1,490.00 | 1,027.00 | 1,844.00 | 2,105.00 | 2,388.00 | |

| 23 | Interest Expense | 1,345.00 | 1,124.00 | 1,761.00 | 1,805.00 | 1,942.00 | 2,916.00 | 2,793.00 | 7,010.00 | |

| 24 | Interest Expense Growth | - | -16.43% | 56.67% | 2.50% | 7.59% | 50.15% | -4.22% | 150.98% | |

| 25 | Gross Interest Expense | 1,345.00 | 1,124.00 | 1,761.00 | 1,805.00 | 1,942.00 | 2,916.00 | 2,793.00 | 7,010.00 | |

| 26 | Pretax Income | 63,810.00 | 57,351.00 | 87,078.00 | 57,853.00 | 30,011.00 | 43,605.00 | 75,336.00 | -129,124.00 | |

| 27 | Pretax Income Growth | - | -10.12% | 51.83% | -33.56% | -48.13% | 45.30% | 72.77% | -271.40% | |

| 28 | Pretax Margin | - | - | - | - | 7.88% | - | - | -94.25% | |

| 29 | Income Tax | 16,629.00 | 14,466.00 | 20,052.00 | 16,212.00 | 16,790.00 | 9,518.00 | 16,768.00 | 26,504.00 | |

| 30 | Income Tax - Current Domestic | 1,068.00 | 3,495.00 | 10,862.00 | 1,396.00 | 6,898.00 | 4,893.00 | -2,369.00 | -555.00 | |

| 31 | Income Tax - Current Foreign | 2,662.00 | 10,344.00 | 10,526.00 | 9,873.00 | 13,909.00 | 11,548.00 | 12,375.00 | 3,441.00 | |

| 32 | Income Tax - Deferred Domestic | 13,198.00 | -433 | 518 | 3,583.00 | -8,748.00 | -5,993.00 | 3,913.00 | 10,801.00 | |

| 33 | Income Tax - Deferred Foreign | -299 | 1,060.00 | -1,854.00 | 1,360.00 | 4,731.00 | -930.00 | 2,849.00 | 12,817.00 | |

| 34 | Equity in Affiliates | -2,757.00 | -1,071.00 | -2,402.00 | -2,321.00 | -703 | -492 | 3 | -1858 | |

| 35 | Other After Tax Income (Expense) | - | -426 | -769 | - | - | - | - | ||

| 36 | Consolidated Net Income | 44,424.00 | 41,388.00 | 63,855.00 | 39,320.00 | 12,518.00 | 33,595.00 | 58,571.00 | -157,486.00 | |

| 37 | Minority Interest Expense | - | 2,433.00 | 8,780.00 | 10,532.00 | 10,174.00 | 10,751.00 | 11,705.00 | -13,711.00 | |

| 38 | Net Income | 44,424.00 | 38,955.00 | 55,075.00 | 28,788.00 | 2,344.00 | 22,844.00 | 46,866.00 | -143,775.00 | |

| 39 | Net Income Growth | - | -12.31% | 41.38% | -47.73% | -91.86% | 874.57% | 105.16% | -406.78% | <– =(F38-E38)/E38 |

| 40 | Net Margin | - | - | - | - | 0.62% | - | - | -104.94% | |

| 41 | Extraordinaries & Discontinued Operations | -309 | 355 | - | - | - | - | - | - | |

| 42 | Discontinued Operations | -309 | 355 | - | - | - | - | - | - | |

| 43 | Net Income After Extraordinaries | 44,733.00 | 38,600.00 | 55,075.00 | 28,788.00 | 2,344.00 | 22,844.00 | 46,866.00 | -143,775.00 | |

| 44 | Net Income Available to Common | 44,115.00 | 39,310.00 | 55,075.00 | 28,788.00 | 2,344.00 | 22,844.00 | 46,866.00 | -143,775.00 | |

| 45 | EPS (Basic) | 0.66 | 0.58 | 0.79 | 0.43 | 0.04 | 0.36 | 0.76 | -2.43 | |

| 46 | EPS (Basic) Growth | - | -12.85% | 37.34% | -45.57% | -90.70% | 805.50% | 111.04% | -417.52% | |

| 47 | Basic Shares Outstanding | 67,151.00 | 68,346.00 | 69,526.00 | 67,575.00 | 65,380.00 | 63,075.00 | 61,310.00 | 59,237.00 | |

| 48 | EPS (Diluted) | 0.64 | 0.56 | 0.78 | 0.42 | 0.04 | 0.36 | 0.76 | -2.43 | |

| 49 | EPS (Diluted) Growth | - | -11.91% | 37.53% | -45.59% | -91.52% | 910.55% | 110.89% | -418.44% | |

| 50 | Diluted Shares Outstanding | 68,961.00 | 69,754.00 | 71,058.00 | 68,263.00 | 65,540.00 | 63,207.00 | 61,489.00 | 59,237.00 | |

| 51 | EBITDA | 101,539.00 | 97,996.00 | 137,651.00 | 112,210.00 | 112,816.00 | 127,077.00 | 145,361.00 | -62,283.00 | |

| 52 | EBITDA Growth | - | -3.49% | 40.47% | -18.48% | 0.54% | 12.64% | 14.39% | -142.85% | |

| 53 | EBITDA Margin | - | - | - | - | 29.63% | - | - | -45.46% | |

| 54 | EBIT | 64,854.00 | 65,066.00 | 95,864.00 | 66,257.00 | 46,571.00 | 70,746.00 | 82,383.00 | -114,987.00 | |

| 55 | Balance Sheet | |||||||||

| 56 | Assets | |||||||||

| 57 | Fiscal year is January-December. All values USD Thousands. | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| 58 | Cash & Short Term Investments | 29,546.00 | 106,503.00 | 317,449.00 | 204,759.00 | 158,725.00 | 141,590.00 | 109,484.00 | 317,379.00 | |

| 59 | Cash Only | 29,546.00 | 106,503.00 | 317,449.00 | 204,759.00 | 158,725.00 | 141,590.00 | 109,484.00 | 317,379.00 | |

| 60 | Cash & Short Term Investments Growth | - | 260.47% | 198.07% | -35.50% | -22.48% | -10.80% | -22.68% | 189.89% | |

| 61 | Cash & ST Investments / Total Assets | 6.14% | 17.14% | 34.10% | 23.88% | 18.32% | 16.21% | 12.31% | 31.81% | |

| 62 | Total Accounts Receivable | 90,409.00 | 91,595.00 | 117,049.00 | 118,329.00 | 156,001.00 | 120,220.00 | 127,108.00 | 91,237.00 | |

| 63 | Accounts Receivables, Net | 73,074.00 | 76,051.00 | 97,981.00 | 96,349.00 | 130,546.00 | 120,220.00 | 127,108.00 | 91,237.00 | |

| 64 | Accounts Receivables, Gross | 73,961.00 | 76,998.00 | 99,695.00 | 97,599.00 | 132,513.00 | 123,250.00 | 132,246.00 | 105,532.00 | |

| 65 | Bad Debt/Doubtful Accounts | -887 | -947 | -1,714.00 | -1,250.00 | -1,967.00 | -3,030.00 | -5,138.00 | -14,295.00 | |

| 66 | Other Receivables | 17,335.00 | 15,544.00 | 19,068.00 | 21,980.00 | 25,455.00 | - | - | - | |

| 67 | Accounts Receivable Growth | - | 1.31% | 27.79% | 1.09% | 31.84% | -22.94% | 5.73% | -28.22% | |

| 68 | Accounts Receivable Turnover | 3.18 | 3.17 | 3.19 | 3.19 | 2.44 | 3.11 | 3.11 | 1.5 | |

| 69 | Inventories | 9,825.00 | 17,063.00 | 38,753.00 | 42,121.00 | 30,788.00 | 44,560.00 | 42,989.00 | 39,580.00 | |

| 70 | Finished Goods | 5,004.00 | 6,705.00 | 10,375.00 | 10,303.00 | 6,981.00 | 10,122.00 | 11,843.00 | 6,470.00 | |

| 71 | Work in Progress | 500 | 1,211.00 | 2,628.00 | 3,818.00 | 2,601.00 | 4,733.00 | 4,608.00 | 3,014.00 | |

| 72 | Raw Materials | 4,321.00 | 9,147.00 | 25,750.00 | 28,000.00 | 21,206.00 | 29,705.00 | 26,538.00 | 30,096.00 | |

| 73 | Other Current Assets | 3,602.00 | 4,946.00 | 6,498.00 | 6,626.00 | 7,549.00 | 10,294.00 | 10,237.00 | 10,420.00 | |

| 74 | Prepaid Expenses | 3,602.00 | 4,946.00 | 6,498.00 | 6,626.00 | 7,549.00 | 10,294.00 | 10,237.00 | 10,420.00 | |

| 75 | Total Current Assets | 133,382.00 | 220,107.00 | 479,749.00 | 371,835.00 | 353,063.00 | 316,664.00 | 289,818.00 | 458,616.00 | |

| 76 | Net Property, Plant & Equipment | 132,847.00 | 183,424.00 | 218,267.00 | 245,415.00 | 276,781.00 | 280,658.00 | 306,849.00 | 277,397.00 | |

| 77 | Property, Plant & Equipment - Gross | 225,337.00 | 290,436.00 | 328,244.00 | 378,203.00 | 427,511.00 | 451,979.00 | 497,654.00 | 501,384.00 | |

| 78 | Buildings | 15,832.00 | 16,584.00 | 67,150.00 | 69,861.00 | 74,478.00 | 77,468.00 | 80,850.00 | 80,875.00 | |

| 79 | Land & Improvements | 1,593.00 | 8,180.00 | 8,203.00 | 8,203.00 | 8,203.00 | 8,203.00 | 8,203.00 | 8,203.00 | |

| 80 | Construction in Progress | 8,055.00 | 43,250.00 | 9,616.00 | 18,315.00 | 23,398.00 | 24,327.00 | 14,483.00 | 5,660.00 | |

| 81 | Leases | - | - | - | - | - | - | 17147 | 15553 | |

| 82 | Leased Property | 162,783.00 | 184,489.00 | 205,367.00 | 230,629.00 | 270,016.00 | 292,146.00 | 327,684.00 | 342,670.00 | |

| 83 | Other Property, Plant & Equipment | 37,074.00 | 37,933.00 | 37,908.00 | 51,195.00 | 51,416.00 | 49,835.00 | 49,287.00 | 48,423.00 | |

| 84 | Accumulated Depreciation | 92,490.00 | 107,012.00 | 109,977.00 | 132,788.00 | 150,730.00 | 171,321.00 | 190,805.00 | 223,987.00 | |

| 85 | Buildings | 10,410.00 | 10,998.00 | 12,679.00 | 14,877.00 | 17,364.00 | 20,012.00 | 22,931.00 | 25,921.00 | |

| 86 | Leases | 54,273.00 | 66,736.00 | 77,936.00 | 92,950.00 | 107,861.00 | 124,112.00 | 137,978.00 | 163,300.00 | |

| 87 | Leased Property | 54,273.00 | 66,736.00 | 77,936.00 | 92,950.00 | 107,861.00 | 124,112.00 | 137,978.00 | 163,300.00 | |

| 88 | Other Property, Plant & Equipment | 27,807.00 | 29,278.00 | 19,362.00 | 24,961.00 | 25,505.00 | 27,197.00 | 29,011.00 | 33,124.00 | |

| 89 | Total Investments and Advances | 5,784.00 | 3,384.00 | 2,198.00 | 3,869.00 | 11,358.00 | 5,244.00 | 19,742.00 | 16,612.00 | |

| 90 | LT Investment - Affiliate Companies | 5,784.00 | 3,384.00 | 2,198.00 | 1,389.00 | 3,484.00 | - | 15,685.00 | 13,633.00 | |

| 91 | Other Long-Term Investments | - | - | - | 2,480.00 | 7,874.00 | 5,244.00 | 4,057.00 | 2,979.00 | |

| 92 | Long-Term Note Receivable | 89,775.00 | 90,292.00 | 101,005.00 | 102,853.00 | 106,747.00 | 136,506.00 | 140,483.00 | 137,399.00 | |

| 93 | Intangible Assets | 66,772.00 | 66,578.00 | 67,977.00 | 69,443.00 | 70,238.00 | 73,122.00 | 69,374.00 | 65,272.00 | |

| 94 | Net Goodwill | 39,027.00 | 39,027.00 | 39,027.00 | 39,027.00 | 39,027.00 | 39,027.00 | 39,027.00 | 39,027.00 | |

| 95 | Net Other Intangibles | 27,745.00 | 27,551.00 | 28,950.00 | 30,416.00 | 31,211.00 | 34,095.00 | 30,347.00 | 26,245.00 | |

| 96 | Other Assets | 28,326.00 | 34,690.00 | 36,058.00 | 43,140.00 | 17,717.00 | 30,142.00 | 38,898.00 | 24,471.00 | |

| 97 | Deferred Charges | 9,294.00 | 25,457.00 | 26,273.00 | 32,963.00 | 6,208.00 | 16,367.00 | 17,921.00 | 5,777.00 | |

| 98 | Tangible Other Assets | 19,032.00 | 9,233.00 | 9,785.00 | 10,177.00 | 11,509.00 | 13,775.00 | 20,977.00 | 18,694.00 | |

| 99 | Total Assets | 481,145.00 | 621,533.00 | 931,020.00 | 857,334.00 | 866,612.00 | 873,600.00 | 889,069.00 | 997,750.00 | |

| 100 | Assets - Total - Growth | - | 29.18% | 49.79% | -7.91% | 1.08% | 0.81% | 1.77% | 12.22% | |

| 101 | Asset Turnover | - | - | - | - | 0.44 | - | - | 0.15 | |

| 102 | Return On Average Assets | - | - | - | - | 0.27% | - | - | -15.24% | |

| 103 | All values USD Thousands. | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| 104 | ST Debt & Current Portion LT Debt | - | - | 2,000.00 | - | 2,000.00 | - | 18,677.00 | 16,634.00 | |

| 105 | Short Term Debt | - | - | - | - | - | - | 18677 | 16634 | |

| 106 | Current Portion of Long Term Debt | - | - | 2,000.00 | - | 2,000.00 | - | - | - | |

| 107 | Accounts Payable | 19,396.00 | 26,145.00 | 23,455.00 | 19,990.00 | 24,235.00 | 32,057.00 | 20,414.00 | 20,837.00 | |

| 108 | Accounts Payable Growth | - | 34.80% | -10.29% | -14.77% | 21.24% | 32.28% | -36.32% | 2.07% | |

| 109 | Other Current Liabilities | 142,164.00 | 163,991.00 | 200,741.00 | 183,474.00 | 213,410.00 | 204,433.00 | 188,654.00 | 170,702.00 | |

| 110 | Accrued Payroll | 1,600.00 | 101.5 | 1,800.00 | - | - | - | - | - | |

| 111 | Miscellaneous Current Liabilities | 140,564.00 | 163,889.50 | 198,941.00 | 183,474.00 | 213,410.00 | 204,433.00 | 188,654.00 | 170,702.00 | |

| 112 | Total Current Liabilities | 161,560.00 | 190,136.00 | 226,196.00 | 203,464.00 | 239,645.00 | 236,490.00 | 227,745.00 | 208,173.00 | |

| 113 | Current Ratio | 0.83 | 1.16 | 2.12 | 1.83 | 1.47 | 1.34 | 1.27 | 2.2 | |

| 114 | Quick Ratio | 0.76 | 1.07 | 1.95 | 1.62 | 1.34 | 1.15 | 1.08 | 2.01 | |

| 115 | Cash Ratio | 0.18 | 0.56 | 1.4 | 1.01 | 0.66 | 0.6 | 0.48 | 1.52 | |

| 116 | Long-Term Debt | - | 4,710.00 | 27,667.00 | 27,316.00 | 23,357.00 | 37,753.00 | 18,229.00 | 305,676.00 | |

| 117 | Long-Term Debt excl. Capitalized Leases | - | 4,710.00 | 27,667.00 | 27,316.00 | 23,357.00 | 37,753.00 | 18,229.00 | 305,676.00 | |

| 118 | Non-Convertible Debt | - | 4,710.00 | 27,667.00 | 27,316.00 | 23,357.00 | 37,753.00 | 18,229.00 | 305,676.00 | |

| 119 | Deferred Taxes | -24,259.00 | -23,058.00 | -25,766.00 | -20,779.00 | -30,708.00 | -31,264.00 | -23,905.00 | 1,151.00 | |

| 120 | Deferred Taxes - Credit | - | - | - | - | - | - | - | 19134 | |

| 121 | Deferred Taxes - Debit | 24,259.00 | 23,058.00 | 25,766.00 | 20,779.00 | 30,708.00 | 31,264.00 | 23,905.00 | 17,983.00 | |

| 122 | Total Liabilities | 161,560.00 | 194,846.00 | 253,863.00 | 230,780.00 | 263,002.00 | 274,243.00 | 245,974.00 | 532,983.00 | |

| 123 | Total Liabilities / Total Assets | 33.58% | 31.35% | 27.27% | 26.92% | 30.35% | 31.39% | 27.67% | 53.42% | |

| 124 | Common Equity (Total) | 319,585.00 | 382,775.00 | 623,891.00 | 562,012.00 | 527,746.00 | 512,161.00 | 547,694.00 | 385,489.00 | |

| 125 | Common Stock Par/Carry Value | 327,313.00 | 344,862.00 | 448,310.00 | 439,213.00 | 445,797.00 | 422,455.00 | 423,386.00 | 407,031.00 | |

| 126 | Retained Earnings | -43,051.00 | -6,259.00 | 19,930.00 | -47,366.00 | -87,592.00 | -85,385.00 | -40,253.00 | -202,849.00 | |

| 127 | Other Appropriated Reserves | 35,323.00 | 44,172.00 | 155,651.00 | 172,104.00 | 174,674.00 | 176,007.00 | 168,599.00 | 181,318.00 | |

| 128 | Treasury Stock | - | - | - | -1,939.00 | -5,133.00 | -916.00 | -4,038.00 | -11.00 | |

| 129 | Common Equity / Total Assets | 66.42% | 61.59% | 67.01% | 65.55% | 60.90% | 58.63% | 61.60% | 38.64% | |

| 130 | Total Shareholders’ Equity | 319,585.00 | 382,775.00 | 623,891.00 | 562,012.00 | 527,746.00 | 512,161.00 | 547,694.00 | 385,489.00 | |

| 131 | Total Shareholders’ Equity / Total Assets | 66.42% | 61.59% | 67.01% | 65.55% | 60.90% | 58.63% | 61.60% | 38.64% | |

| 132 | Accumulated Minority Interest | - | 43,912.00 | 53,266.00 | 64,542.00 | 75,864.00 | 87,196.00 | 95,401.00 | 79,278.00 | |

| 133 | Total Equity | 319,585.00 | 426,687.00 | 677,157.00 | 626,554.00 | 603,610.00 | 599,357.00 | 643,095.00 | 464,767.00 | |

| 134 | Liabilities & Shareholders’ Equity | 481,145.00 | 621,533.00 | 931,020.00 | 857,334.00 | 866,612.00 | 873,600.00 | 889,069.00 | 997,750.00 | |

| 135 | Cash Flow | |||||||||

| 136 | Fiscal year is January-December. All values USD Thousands. | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| 137 | Net Income before Extraordinaries | 44,115.00 | 42,169.00 | 64,624.00 | 39,320.00 | 12,518.00 | 33,595.00 | 58,571.00 | -157,486.00 | |

| 138 | Net Income Growth | - | -4.41% | 53.25% | -39.16% | -68.16% | 168.37% | 74.34% | -368.88% | |

| 139 | Depreciation, Depletion & Amortization | 36,685.00 | 32,930.00 | 40,887.00 | 45,953.00 | 66,245.00 | 56,331.00 | 62,978.00 | 52,704.00 | |

| 140 | Depreciation and Depletion | 16,239.00 | 17,764.00 | 21,361.00 | 25,532.00 | 29,915.00 | 33,903.00 | 35,630.00 | 36,155.00 | |

| 141 | Amortization of Intangible Assets | 20,446.00 | 15,166.00 | 19,526.00 | 20,421.00 | 36,330.00 | 22,428.00 | 27,348.00 | 16,549.00 | |

| 142 | Deferred Taxes & Investment Tax Credit | 12,899.00 | 627 | -1,336.00 | 4,940.00 | -4,017.00 | -6,923.00 | 6,762.00 | 23,618.00 | |

| 143 | Deferred Taxes | 12,899.00 | 627 | -1,336.00 | 4,940.00 | -4,017.00 | -6,923.00 | 6,762.00 | 23,618.00 | |

| 144 | Other Funds | -4,911.00 | 4,822.00 | 16,088.00 | 18,533.00 | 19,761.00 | 14,522.00 | 7,994.00 | 61,861.00 | |

| 145 | Funds from Operations | 88,788.00 | 80,548.00 | 120,263.00 | 108,746.00 | 94,507.00 | 97,525.00 | 136,305.00 | -19,303.00 | |

| 146 | Changes in Working Capital | -33,755.00 | 6,057.00 | -36,578.00 | -30,874.00 | -9,141.00 | 12,447.00 | -45,929.00 | -3,708.00 | |

| 147 | Receivables | -31,032.00 | -4,358.00 | -36,149.00 | -5,909.00 | -45,060.00 | 35,267.00 | -12,997.00 | 20,668.00 | |

| 148 | Inventories | 1,884.00 | -7,603.00 | -21,070.00 | -3,825.00 | 10,832.00 | -14,022.00 | 1,942.00 | 1,637.00 | |

| 149 | Accounts Payable | 7,238.00 | -5,186.00 | 9,183.00 | -3,360.00 | 4,204.00 | 7,749.00 | -11,774.00 | 414.00 | |

| 150 | Other Accruals | -1,289.00 | 5,702.00 | -2,577.00 | 3,914.00 | -642 | -3266 | -8505 | -6399 | |

| 151 | Other Assets/Liabilities | -10,556.00 | 17,502.00 | 14,035.00 | -21,694.00 | 21,525.00 | -13,281.00 | -14,595.00 | -20,028.00 | |

| 152 | Net Operating Cash Flow | 55,033.00 | 86,605.00 | 83,685.00 | 77,872.00 | 85,366.00 | 109,972.00 | 90,376.00 | -23,011.00 | |

| 153 | Net Operating Cash Flow Growth | - | 57.37% | -3.37% | -6.95% | 9.62% | 28.82% | -17.82% | -125.46% | |

| 154 | Net Operating Cash Flow / Sales | 19.11% | 29.81% | 22.39% | 20.64% | 22.42% | 29.37% | 22.84% | -16.80% | |

| 155 | All values USD Thousands. | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| 156 | Capital Expenditures | -15,502.00 | -43,022.00 | -48,322.00 | -20,065.00 | -29,357.00 | -22,064.00 | -10,352.00 | -2,601.00 | |

| 157 | Capital Expenditures (Fixed Assets) | -13,016.00 | -40,104.00 | -43,257.00 | -15,278.00 | -24,143.00 | -13,368.00 | -7,421.00 | -697.00 | |

| 158 | Capital Expenditures (Other Assets) | -2,486.00 | -2,918.00 | -5,065.00 | -4,787.00 | -5,214.00 | -8,696.00 | -2,931.00 | -1,904.00 | |

| 159 | Capital Expenditures Growth | - | -177.53% | -12.32% | 58.48% | -46.31% | 24.84% | 53.08% | 74.87% | |

| 160 | Capital Expenditures / Sales | -5.38% | -14.81% | -12.93% | -5.32% | -7.71% | -5.89% | -2.62% | -1.90% | |

| 161 | Net Assets from Acquisitions | -4,000.00 | -2,500.00 | -2,000.00 | -1,911.00 | -1,606.00 | - | - | - | |

| 162 | Sale of Fixed Assets & Businesses | - | 507 | - | - | - | -34810 | -55642 | -6654 | |

| 163 | Purchase/Sale of Investments | -22,775.00 | -16,838.00 | -28,474.00 | -42,910.00 | -42,634.00 | -34,810.00 | -55,642.00 | -6,654.00 | |

| 164 | Purchase of Investments | -22,775.00 | -16,838.00 | -28,474.00 | -42,910.00 | -42,634.00 | -34,810.00 | -55,642.00 | -6,654.00 | |

| 165 | Net Investing Cash Flow | -42,277.00 | -61,853.00 | -78,796.00 | -64,886.00 | -73,597.00 | -56,874.00 | -65,994.00 | -9,255.00 | |

| 166 | Net Investing Cash Flow Growth | - | -46.30% | -27.39% | 17.65% | -13.43% | 22.72% | -16.04% | 85.98% | |

| 167 | Net Investing Cash Flow / Sales | -14.68% | -21.29% | -21.08% | -17.20% | -19.33% | -15.19% | -16.68% | -6.76% | |

| 168 | All values USD Thousands. | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| 169 | Change in Capital Stock | 8,768.00 | 48,766.00 | 201,302.00 | -102,922.00 | -34,605.00 | -74,915.00 | -32,144.00 | -41,244.00 | |

| 170 | Repurchase of Common & Preferred Stk. | - | -3,063.00 | -34,276.00 | -118,514.00 | -51,273.00 | -83,728.00 | -35,654.00 | -41,244.00 | |

| 171 | Sale of Common & Preferred Stock | 8,768.00 | 51,829.00 | 235,578.00 | 15,592.00 | 16,668.00 | 8,813.00 | 3,510.00 | - | |

| 172 | Proceeds from Stock Options | -202 | 40,995.00 | 199,969.00 | 2,479.00 | - | 7796 | 1106 | - | |

| 173 | Other Proceeds from Sale of Stock | 8,970.00 | 10,834.00 | 35,609.00 | 13,113.00 | 16,668.00 | 1,017.00 | 2,404.00 | - | |

| 174 | Issuance/Reduction of Debt, Net | -13,151.00 | 4,283.00 | 23,424.00 | -2,000.00 | -2,000.00 | 12,424.00 | -20,000.00 | 286,537.00 | |

| 175 | Change in Current Debt | -13,151.00 | - | - | - | - | - | - | - | |

| 176 | Change in Long-Term Debt | - | 4,283.00 | 23,424.00 | -2,000.00 | -2,000.00 | 12,424.00 | -20,000.00 | 286,537.00 | |

| 177 | Issuance of Long-Term Debt | - | 4,283.00 | 23,757.00 | - | - | 63091 | 35000 | 286537 | |

| 178 | Reduction in Long-Term Debt | - | - | -333 | -2,000.00 | -2,000.00 | -50,667.00 | -55,000.00 | - | |

| 179 | Other Funds | - | -790 | -19,511.00 | -20,860.00 | -20,931.00 | -8,371.00 | -4,974.00 | -4,726.00 | |

| 180 | Other Uses | - | -790 | -19,511.00 | -20,860.00 | -20,931.00 | -8,371.00 | -4,974.00 | -4,726.00 | |

| 181 | Net Financing Cash Flow | -4,383.00 | 52,259.00 | 205,215.00 | -125,782.00 | -57,536.00 | -70,862.00 | -57,118.00 | 240,567.00 | |

| 182 | Net Financing Cash Flow Growth | - | 1292.31% | 292.69% | -161.29% | 54.26% | -23.16% | 19.40% | 521.18% | |

| 183 | Net Financing Cash Flow / Sales | -1.52% | 17.99% | 54.90% | -33.33% | -15.11% | -18.93% | -14.44% | 175.59% | |

| 184 | Exchange Rate Effect | -163 | -54 | 842 | 106 | -267 | 629 | 630 | -406 | |

| 185 | Net Change in Cash | 8,210.00 | 76,957.00 | 210,946.00 | -112,690.00 | -46,034.00 | -17,135.00 | -32,106.00 | 207,895.00 | |

| 186 | Free Cash Flow | 42,017.00 | 46,501.00 | 40,428.00 | 62,594.00 | 61,223.00 | 96,604.00 | 82,955.00 | -23,708.00 | |

| 187 | Free Cash Flow Growth | - | 10.67% | -13.06% | 54.83% | -2.19% | 57.79% | -14.13% | -128.58% | <– =(F186-E186)/E186 |

| 188 | Optimistic FCF Growth | 26.32% | -4.95% | <– =AVERAGE(B187:F187) | ||||||

| 189 | Pessimistic FCF Growth | 12.56% | -71.35% | <– =AVERAGE(E187:F187) | ||||||

| 190 | Free Cash Flow Yield | - | - | - | - | 4.04% | - | - | -2.22% | |